Trinity hospitality group invite you to new interesting investment fund

Unique distress investment opportunity

Wall Street Luxury Europe is thrilled to support and assist in the fund raising process Trinity Hospitality Group (‘Trinity’) – definitely the most interesting investment proposition for 2021. Trinity is a specialty, core plus, real estate private equity fund focussing on value investments in prime hotel assets. Trinity was conceived to capitalise on the opportunity arising from the Covid-19 pandemic by acquiring assets from distressed sellers and historically profitable assets currently underperforming. With head offices in London, Trinity was established and is managed by seasoned hospitality, investment and private equity professionals. it is a core-plus fund with structural flexibility to drive value in any market situation.

Key investment parameters for either individual hotel assets or portfolios:

- Proven operating cashflow positive hotels

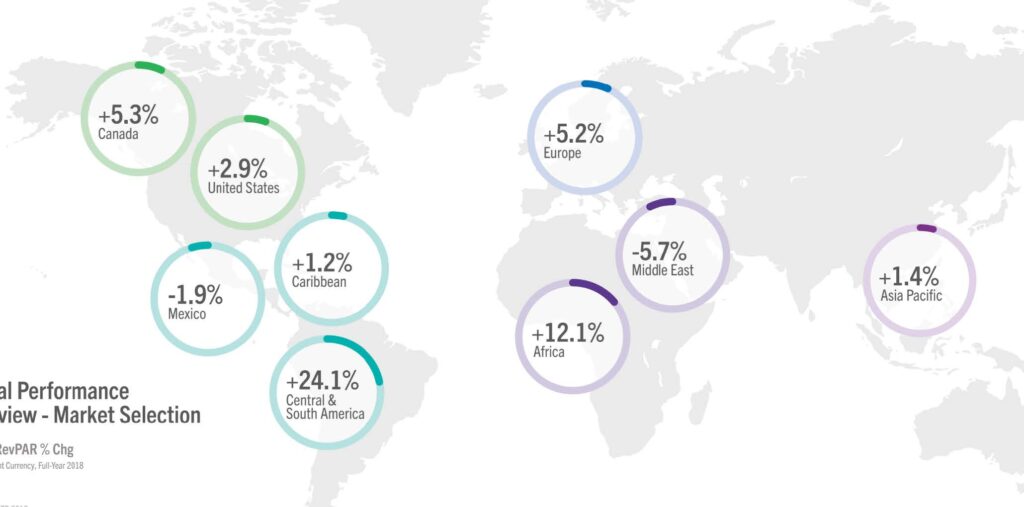

- Optimise risk-adjusted returns by investing in different geographies and assets sustained by different target markets (leisure vs business)

- Focus target markets:

- European and US gateway cities

- established resort locations across Southern Europe, US, Central America and the Caribbean

- Acquisition price to be at notable discount to pre-COVID third-party market valuation as of 31 December 2019

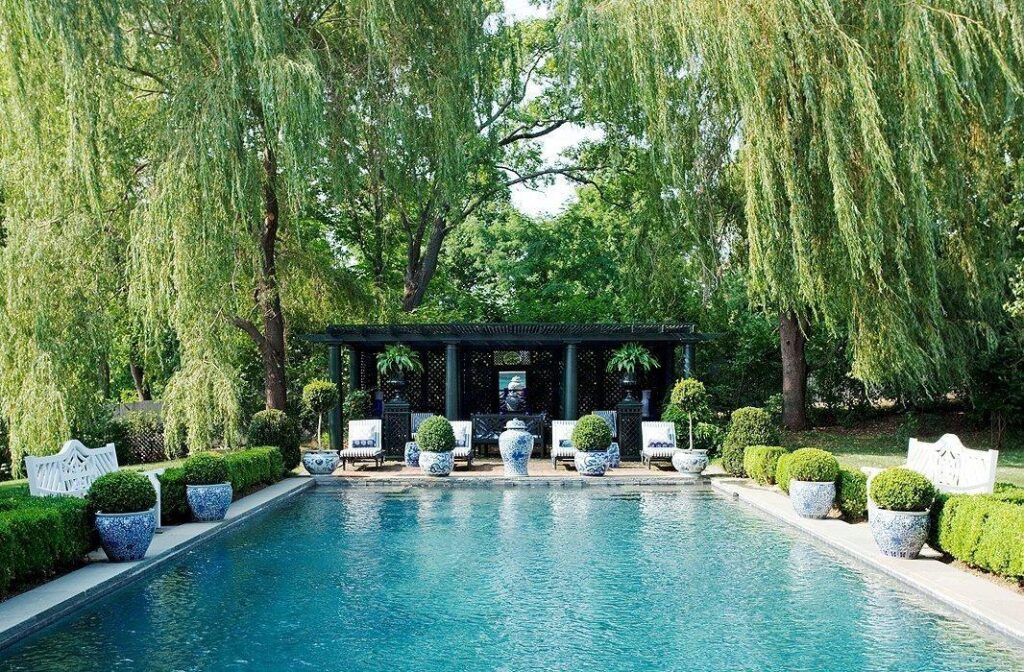

- Following minor or substantial capital expenditure plan, all assets will be in the ‘luxury lifestyle’ bracket

- For the branding and re-positioning of each asset, Trinity will work with best-in-class hotel management/brand companies for each relevant market – lease/franchise/management agreements

- Asset appreciation during the holding period to be driven by market value appreciation post COVID and Trinity’s asset rebranding and management

- Trinity, with an annual IRR of 23% per annum is a great vehicle to diversify one’s real estate exposure and a way to being part of the anticipated recovery and renaissance of the hospitality industry.